The Changing Face of LTC and Caregiving - What You Need to Know

By Gregg Kaufman, CLU, CFP

Long Term Care is one of the fastest changing areas of our business. In the last few years major carriers have left the traditional LTC marketplace whereas others have transitioned into a next-generation type of plan usually involving some kind of life insurance/LTC hybrid design.

A major deficit of traditional LTC plans has been price uncertainty, with many carriers increasing their price sharply on inforce blocks of business. Carriers could not accurately predict the number or duration of claims and have disappointed clients again and again with repeated price increases (euphemistically referred to as “rate actions”).

To bring price stability and certainty to product design, carriers are now leveraging their century-plus experience in pricing mortality risk and applying that to solving the LTC pricing problem. The new generation of LTC and related care products now all use a base design of universal life or whole life and add to that a living benefit, which normally consists of an accelerated benefit.

Accelerated Benefits as Living Benefits

The term “accelerated benefit” refers to the ability of a life contract to repurpose a policy’s death benefit during the client’s lifetime to pay for living needs such as chronic illness or long-term care. Those benefits are subtracted from the remaining death benefit when paid out.

The math is fairly simple. For example:

- A client with a $500,000 UL (with living benefits) needs to go on claim and take $10,000 a month for 6 months to pay for cost of care. At the end of that period the $60,000 of death benefit has been “accelerated” and now the policy would pay the remaining $440,000 on death. (Although the premium usually does NOT go down.) Some contracts accelerate or spend-down the policy’s cash value as well as the remaining death benefit.

Benefit Types: Cash Re-imbursement vs. Indemnity

Benefits paid on LTC plans are usually based on either the re-imbursement model or the indemnity model.

Cash re-imbursement means the client has the responsibility of presenting receipts to the carriers proving that a qualifying and covered case was purchased. Some facilities will automatically transmit cost data to a carrier electronically if an agreement is in place to do that.

Whereas an indemnity plan means the carrier is obligated to pay the full benefit amount once the client starts the claim, regardless if the funds are used to pay for qualified care costs or other related items.

For those reasons cash re-imbursement plans tend to cost less, but there is an important difference in the practical application of these contracts.

The In-Home Care Dilemma and Informal Care

Who will pay for your in-home care?

Many cash re-imbursement plans include a home-care provision that will pay for 100% of qualified in-home care, but that care must be usually provided by a licensed provider and billions of dollars’ worth of care is provided by unlicensed providers – namely family, friends and neighbors.

An important and often overlooked feature of an indemnity plan is that it may pay for so called “informal care” provided by family members. You may ask yourself, “Why would I pay my son or daughter to take care of me? After all – they love me and it’s their obligation." You have to consider that perhaps your son or daughter simply can’t afford to skip work for 20 or 30 hours a week to care for you.

According to a 2014 study by the Rand Corporation, informal care is the primary source of long term care received by the elderly in the US. That amounts to an estimated 30 billion hours of care per year at a value of $520 Billion (which assumes an hourly rate of about $17.40 an hour).1

An indemnity plan may be more expensive than a cash re-imbursement plan premium-wise, but the bigger picture should probably include a discussion of who is likely to provide that care. Having the option of using unlicensed family and friends to provide in-home care might be valuable to many clients, depending on their situation.

It’s difficult to quantify the financial and emotional burden that this amount of unpaid care-giving places on families. Advisors can help offset at least some of this burden by providing advice and risk protection in this area, and the latest long term care products are evolving to meet these needs.

Many carriers offer variations of LTC riders in conjunction with universal or indexed universal life contracts. When presenting these products it’s important to understand some of the following policy features such as:

- The difference between a true LTC rider and a chronic illness rider.

- The difference between an indemnity rider and a cash reimbursement rider.

- How an LTC or chronic care rider can be used to compensate unpaid informal caregivers such as family members and friends.

Who Can Benefit from an LTC/Life Hybrid plan?

- Clients that need and can afford some death benefit.

- Clients healthy enough to pass underwriting for both life and long term care. (Clients who fail LTC underwriting may still qualify for a Chronic Illness rider.)

- Clients who cannot afford a stand-alone LTC plan in addition to life insurance.

- Clients with large 1035s who want to add LTC coverage.

- Other clients that don’t need life insurance may benefit from a traditional LTC plan, or asset-based plan.

Let's Compare Premiums

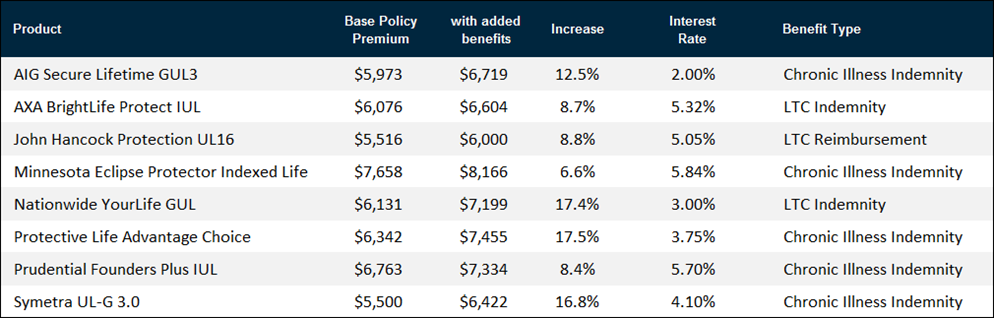

We compared several different products with and without the care benefits. We solved for a 55 year-old preferred male with $500,000 death benefit. Each plan offers a 2% benefit where the $10,000 monthly benefit is based on 2% of the $500,000 face.

Premiums for the $500,000 base coverage range from $5,500 to over $7,000. Adding either an LTC or Chronic care rider adds an average of 12% percent to the premium. A life plan with an LTC rider will likely be much more expensive than a stand-alone LTC plan, but a traditional LTC plan will offer no pricing guarantees and no death benefits in most cases. Whereas the hybrid approach offers a win/win scenario – if you do not use the LTC benefits, your family will receive a nice death benefit with little or no risk of price increases, especially when using a GUL type policy.

* All UL and IULs shown endow at age 120 using current assumptions, and all GUL products guarantee the death benefit to age 100. Contact us for complete sample illustrations. Note: not all products are approved in all states.

Feel free to reach out to any of our GBS Brokerage Mangers for any questions and how to best utilize our resources.