Turbocharge your policy reviews with our brand new speedier review analysis tool

GBS is taking policy review to the next level with a brand new proprietary tool that allows us to analyze the entire marketplace of over 25 available carriers in just a few seconds. Instead of running dozens of illustrations from every carrier, we can tell you within minutes if there is a viable replacement policy out there for your client. Feel free to send us any and all policy statements you have access to and we’ll be happy to review them. Let your centers of influence know you can deliver a faster turnaround time than most other agencies. We can even eliminate the long wait of ordering in-force illustrations in many cases. This tool is only available to run quotes for single life UL and GUL at this time and is only accessible by our in-house staff.

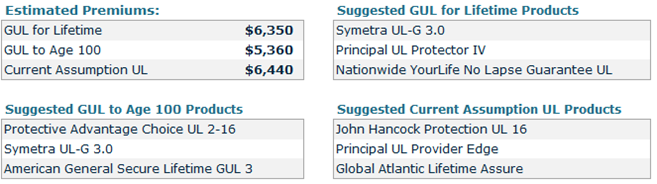

An example of the output is below. Not only does it solve for approximate premium but shows the top carriers in three different solve scenarios per case.

- GUL for lifetime

- GUL to age 100

- Current Assumption UL solves, based on $1 of cash at age 121.

SAMPLE REPORT:

Female 54, Preferred, $78,250 1035 Exchange, $1,000,000 Death Benefit

Below is an average estimated calculation of ongoing premium to support the desired death benefit.

Actual illustrations should be run to confirm replacement options.

Carriers Surveyed: 26

Copyright © 2017 LifeMark Partners. All Rights Reserved. For agent use only. Values are rounded and based off a formulated proprietary calculation. Not to be distributed to the general public.

Start the Conversation

One of our successful producers recently shared a simple way to bring in more policies for review by asking three simple questions - without selling, but rather inquiring:

1. Do you own life insurance?

2. Do you get regular statements from the carrier?

3. Could you please send me a copy of the latest one?

By asking these questions you should yield an increased flow of policy statements and we’ll be happy to review them at the start of our analysis.

There are two possible scenarios:

1. If we can't beat the current policy, then no changes are needed and we’ve performed a useful service that clients can appreciate.

OR

2. We’ve discovered a potential for improving the current situation and possibly even uncovered a real problem that the client was not aware of. In most cases it’s as simple as using the current premium to purchase more coverage or deliver the same amount of coverage with a lower premium. As it often happens today, we might be able to deliver similar coverage amount and similar premium with MORE BENEFITS, especially long-term care or chronic illness riders for little or no extra cost.

A full life insurance review may take more into account than just premium and price. Remember to keep these things in mind:

- Is the appropriate amount of coverage suitable for the need?

- Are additional benefits available today that weren’t available before?

- Will the policy perform as initially sold or require a higher premium?

- Are the beneficiaries correct or does it need to be updated?

- Were any children born or adopted, reached age of majority, marriages or divorces or other changes to the family tree?

Feel free to reach out to any of our GBS Brokerage Mangers for any questions and how to best utilize our resources.