John Hancock Term with Vitality - New and Improved!

Below is the full text of the recent John Hancock memo. Click here for a pdf version.

We've sweetened the deal on term with great rates and more!

NOW APPROVED IN CALIFORNIA

- Significantly improved monthly premiums.

- Lower 10 year term premiums for women.

- Extended conversion feature: now to the end of the level term period, along with an enhanced conversion privilege for achieving Gold or Platinum Vitality Status.

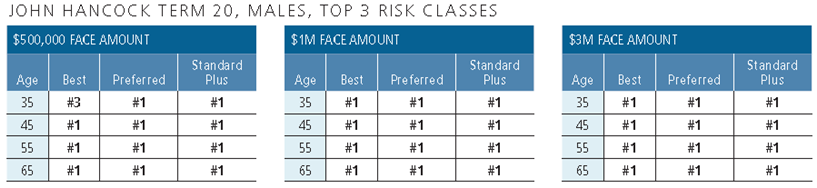

With our new lower rates, we’ve found a sweet spot at the top of the charts!

Competitive Rankings of John Hancock's monthly premium versus 20 leading term carriers.

This comparison was derived from an internal analysis of competitor information between John Hancock and 20 other companies. Companies include: American General, American National, AXA, Banner, Guardian, Lincoln, MetLife, Minnesota Life, Mutual of Omaha, Nationwide, New York Life, North American, Ohio National, Pacific Life, Penn Mutual, Protective, Principal, Prudential, Symetra, and Transamerica. Competitor information was current and accurate to the best of our knowledge as of June 2017. This comparison cannot be used with the public. This example is based on initial premiums. After the first year, premiums for John Hancock Term with Vitality are not guaranteed, because premiums will adjust annually based on a Life Insured’s participation in the program and the Vitality Status they achieve. In order to maintain a level premium a Gold Vitality Status must be achieved in all years.

Healthy Rewards with John Hancock Vitality!

The John Hancock Vitality Program rewards clients for living a healthy life. With it, they can:

- Lower premiums by exercising, eating well, visiting the doctor, and more.

- Save up to $600 a year on the healthy food purchases they make at thousands of stores nationwide.1

- Earn valuable rewards and discounts2 from leading retailers — now starting at face amounts of $100,000.

- Benefit from our customized Vitality Program for clients over the age of 70.

- Earn Apple Watch® Series 2 for as little as $25 plus tax with regular exercise.3

John Hancock Vitality Rewards do vary based on the face amount selected at issue:

With Face Amounts <$2,000,000:

- Complimentary Fitbit® Device & Wearable Device Discounts

- 10% HealthyFood Discount

- 15% Healthy Gear Discount

- Partner Gym Discounts

- Shopping & Entertainment Discounts

- Free Health Check (first program year only)

With Face Amounts >$2,000,000:

- Apple Watch Series 2

- Complimentary Fitbit® Device & Wearable Device Discounts

- 25% HealthyFood Discount

- 25% Healthy Gear Discount

- Partner Gym Discounts

- Shopping & Entertainment Discounts

- Free Annual Health Check

- Half-Price Hotel Stays

- Cruise Rewards

State approvals and illustration system

Please refer to the state approval map for most current state approvals.

New business and underwriting information

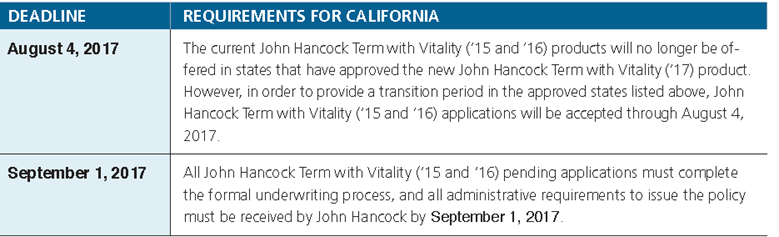

Should you already have an application in New Business and wish to have a John Hancock Term with Vitality (’17) policy underwritten, please contact your Case Manager. Coinciding with the launch of the John Hancock with Term with Vitality (‘17) product, new submissions received at our service office prior to August 4th that do not specify the John Hancock Term with Vitality product version applied for (John Hancock Term with Vitality ’15, John Hancock Term with Vitality ’16, or John Hancock Term with Vitality ‘17) will be set up under the John Hancock Term with Vitality (‘17) product. Please contact your case manager to make any changes to the product selected on pending cases submitted during the transition period. In states that have not yet approved the new John Hancock Term with Vitality (‘17) product, specific transition rules will be communicated as those state approvals are received.

Reissues

Reissues of John Hancock Term (‘15 or ‘16) policies to Term (‘17) will be considered only on John Hancock Term (’15 or ‘16) policies that are within the Free Look period. Subject to normal underwriting practices, policies may require additional evidence to ensure health status has not changed.

Inforce cases

Term-to-Term replacements are not allowed within the first policy year. Any replacement of an inforce policy (after the first policy year) would require replacement forms, be subject to full underwriting, and possibly result in reduced compensation. Please note that the six month product exchange feature is not available on Term products.

1. The HealthyFood benefit is available to your clients on qualified purchases during their first program year regardless of their Vitality Status. In subsequent program years, HealthyFood discounts are available only if they achieve Gold or Platinum status. No matter what their Vitality Status is, they’ll continue to accumulate Vitality Points for the healthy food purchases they make.

2. In New York, entertainment, shopping, and travel rewards are not available and are replaced by healthy living and active lifestyle rewards.

3. Apple Watch Series 2 is only available on term policies with face amounts of > $2,000,000. An iPhone 5 or later is required to use Apple Watch Series 2. The Retail Installment Agreement with the Vitality Group will need to be signed electronically at checkout. Apple Watch is a registered trademark of Apple Inc. All rights reserved. Apple is not a participant in or sponsor of this promotion. Apple Watch Series 2 program is not available in New York.