Understanding the Goodman Rule: How to Avoid a Nasty Tax Liability by Using Proper Beneficiary and Ownership Designations

By Gregg Kaufman, CLU, CFP

When life insurance ownership and beneficiaries aren't structured properly, there is a little known rule that applies to insurance proceeds that can easily cause serious tax problems. This so-called “Goodman” rule, sometimes referred to as the “Unholy Trinity” of life insurance, can rear its ugly head any time there are three different individuals to a transaction, where in most cases, there should only be two. The remedy is usually very painless - simply correct the ownership and/or beneficiary designations so they comply, otherwise penalties can be as high as owing a gift tax on the entire policy proceeds.

There are three parties involved in any life insurance contract and they are:

- The Owner

- The Insured

- The Beneficiary

The simple act of naming three different individuals in these three roles may subject the contract owner to an unwanted tax bill by way of the proceeds being deemed a “gift” to the beneficiary. Below are some typical Goodman Rule violation examples and recommended solutions:

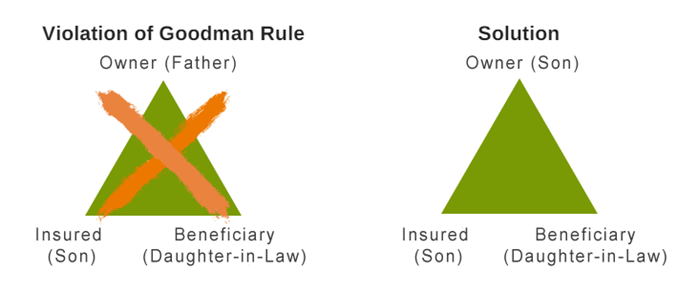

Example 1: Personal Policy

Imagine that a kindhearted father (owner) buys a $500,000 life insurance policy on the life of his adult son (the insured), and names his son’s wife as the beneficiary. If the son dies, his wife will receive the insurance proceeds free from federal income tax. However, under the tax code, the father-in-law just made a $500,000 "gift" to his son’s widow that would result into a potentially large gift tax bill (subject to gifting and estate tax rules and exemptions). The generous father won't be too happy to receive a gift tax bill for approximately 40% of the $500,000. These gift tax assessments are made against the giver of the gift, not the recipient. In the eyes of the IRS, this transaction is no different than if the father had written a check for $500,000 to his daughter-in-law, at least in terms of gift taxation.

Imagine that a kindhearted father (owner) buys a $500,000 life insurance policy on the life of his adult son (the insured), and names his son’s wife as the beneficiary. If the son dies, his wife will receive the insurance proceeds free from federal income tax. However, under the tax code, the father-in-law just made a $500,000 "gift" to his son’s widow that would result into a potentially large gift tax bill (subject to gifting and estate tax rules and exemptions). The generous father won't be too happy to receive a gift tax bill for approximately 40% of the $500,000. These gift tax assessments are made against the giver of the gift, not the recipient. In the eyes of the IRS, this transaction is no different than if the father had written a check for $500,000 to his daughter-in-law, at least in terms of gift taxation.

The solution - avoid the “Unholy Trinity” by naming only two individuals on the insurance contract instead of three. The son could be the owner as well as the insured and the Father could still act as premium payor.

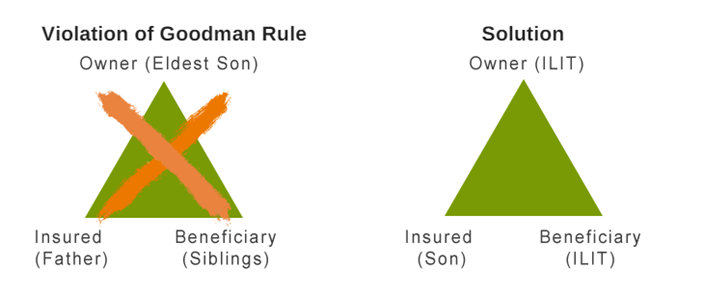

Example 2: Estate Planning

In some instances, estate planning cases can run afoul of the Goodman rule unintentionally. Let’s say a wealthy client prefers to make his eldest son the owner of an insurance policy to avoid the costs of creating an ILIT (Irrevocable Life Insurance Trust). That might work if the son were the only beneficiary of the trust, but if the son had siblings intended as beneficiaries, then upon the grantor’s death, giving those siblings some of the death proceeds would have created a violation of the Goodman rule. The son who owned the policy would be deemed to have made a large gift to each sibling which would now incur a gift tax. Trying to save a few dollars on legal fees upfront might actually cost a lot more in the long run, which is another reason why trusts are commonly used for estate planning cases instead of personal ownership.

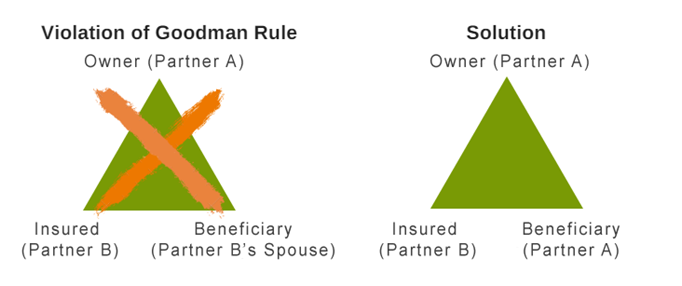

Example 3: Business Cases

A Goodman rule violation can easily come up in business cross-purchase arrangements. For example, Business Partner A buys a policy on the life of Partner B and decides to make Partner B’s spouse the beneficiary in hopes to “simplify things”. This actually complicates matters and again, the “unholy trinity” could cause a gifting issue from Partner A to the surviving spouse of Partner B. (This arrangement may also cause other issues regarding the intended stock redemption transaction.) The solution would be to make Partner A not only the owner but also the beneficiary of the policy. That way the surviving partner still retains control of the funds and bargaining power to negotiate the purchase of the stock.

A Goodman rule violation can easily come up in business cross-purchase arrangements. For example, Business Partner A buys a policy on the life of Partner B and decides to make Partner B’s spouse the beneficiary in hopes to “simplify things”. This actually complicates matters and again, the “unholy trinity” could cause a gifting issue from Partner A to the surviving spouse of Partner B. (This arrangement may also cause other issues regarding the intended stock redemption transaction.) The solution would be to make Partner A not only the owner but also the beneficiary of the policy. That way the surviving partner still retains control of the funds and bargaining power to negotiate the purchase of the stock.

Origin

This situation harkens back to a court case from 1946 called, Goodman vs. Commisioner of Internal Revenue, and still impacts today’s planning. The gist of the ruling is that the owner of any policy has the right to choose who to give the proceeds to. Even if there is a handshake agreement to forward the proceeds to the insured’s family members, the third-party owner ultimately has the legal right to choose any beneficiaries and the courts recognize that as a tangible gifting power.

Policy and Beneficiary Review

Don't get caught in the "unholy trinity," be sure to look for these violations when doing life insurance policy reviews. The beneficiary review aspects can be just as important as the policy performance.

Complete our GBS Quick Life Policy Review Fact-Finder and we can help you do a fast thumbnail review of your client's inforce life insurance policies with just a few inputs.

For questions or more information, feel free to contact a GBS Brokerage Manager at any time.

Disclaimer: The information contained herein is of a general nature and is not intended to address the circumstances of any specific individual, entity or situation. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. No one should act upon such general information without obtaining appropriate professional or legal advice. We endeavor to provide accurate and current information, but we cannot guarantee that such information is accurate at the time of publication or at any later time.